sustainable-finance

The Sustainability Link Loan (“SLL”) sets Sustainability Performance Targets (“SPT”) that correspond to a borrower’s sustainability goals based on its business strategy. By linking loan conditions and SPT progress status, the SLL motivates borrowers to achieve their goals, and supports their sustainable business activities as well as growth from environmental and social perspectives.

The Norinchukin Bank and Megmilk Snow Brand Co., Ltd. entered into a syndicated loan agreement for the SLL in line with the SLL Principles established by the Loan Market Association* (hereafter “JA Bank Syndicated SLL”). The JA Bank Syndicated SLL is arranged by The Norinchukin Trust & Banking Co., Ltd (President & Representative Director: TAKAHASHI Shigemitsu) and syndicated by JA Bank members. It is the first SLL for JA Bank syndication to the Japanese food industry.

In consideration of the Megmilk Snow Brand Group’s targets based on the important CSR issues(materiality), we set SPT of reducing CO₂ emissions (50% reduction by fiscal 2030, compared to fiscal 2013) to this SLL..

*The Loan Market Association aims to improve the liquidity, efficiency, and transparency of the syndicated loan market in Europe, the Middle East, and Africa. It is comprised of more than 700 institutions in more than 60 countries.

| Item | Contents |

| Implementation date | March 14, 2022 |

| Contract period | 6 years |

| Originated amount | JPY 8,000,000,000 |

| Lenders | JA Hokkaido Shinnoren JA Niigata Shinnoren JA Ibaraki Shinnoren JA Saitama Shinnoren JA Shizuoka Shinnoren JA Kyoto Shinnoren JA Hyogo Shinnoren JA Fukuoka Shinnoren JA Okinawa |

| Agent | The Norinchukin Bank |

| Arranger | The Norinchukin Trust Banking Co., Ltd. |

[PDF] JA Bank Syndicate signs into Sustainability Linked Loan Agreement with Megmilk Snow Brand Co., Ltd.

Green Bond

| Name | MEGMILK SNOW BRAND Co., Ltd 2nd Series of Unsecured Corporate Bond (with inter-bond pari passu clause; Green Bond) |

| Maturity | 5 years |

| amount | 5.0 billion yen |

| Coupon | 0.460% |

| Issue Date | December 8, 2022 |

| Lead Managers | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Mizuho Securities Co., Ltd. Daiwa Securities Co. Ltd. |

| Structuring Agent | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. |

| Financial Agent | The Norinchukin Bank |

| Second-party opinion | We have obtained a second-party opinion from R&I, an independent external reviewer, on the alignment of our Green Bond Framework*4 with the Green Bond Principles 2021 (ICMA) and the Green Bond Guidelines 2022 (MOE). |

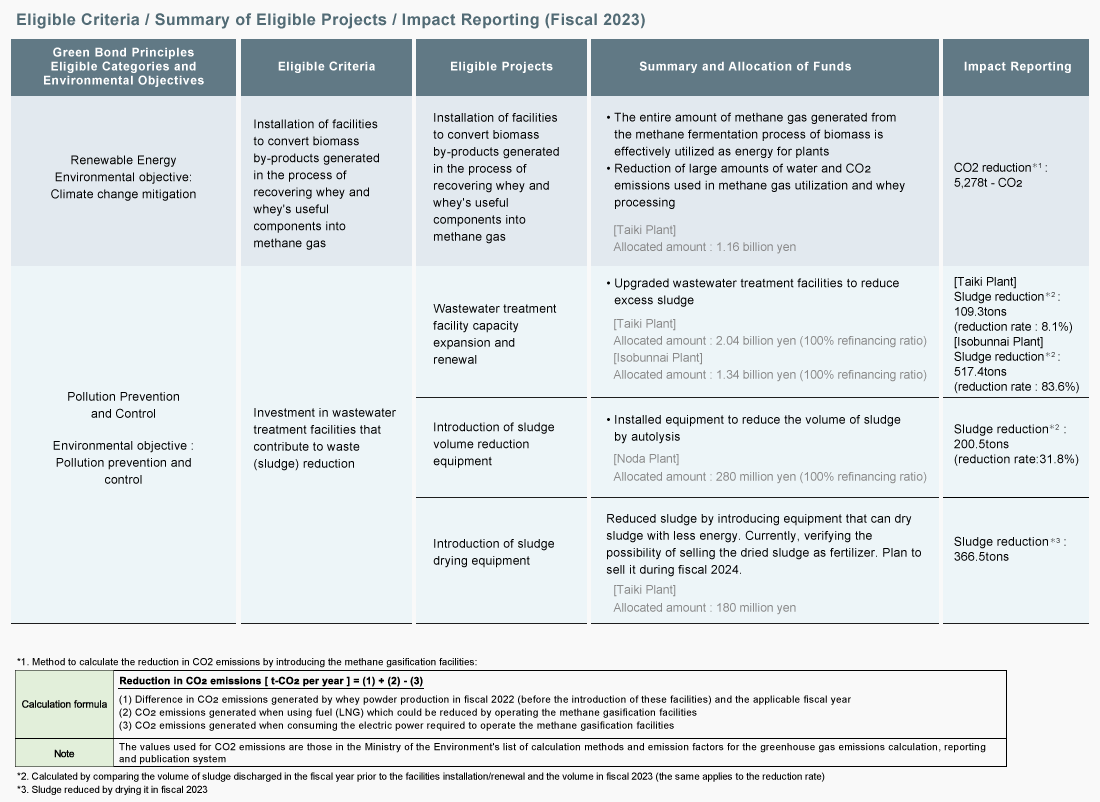

| Use of Proceeds | The funds will be used for the following capital investments that will contribute to reducing environmental impact. (1) Installation of facilities to convert biomass by-products generated in the process of recovering whey and whey’s useful components into methane gas: Taiki Plant (2) Investment in wastewater treatment facilities that contribute to waste (sludge) reduction |

Reporting