Operating Results and Financial Analysis

FY3/2019 Analysis of Operating Results

Status of operations

In accordance with Group Medium-term Management Plan 2019, the MEGMILK SNOW BRAND Group endeavored to strengthen the earnings base in preparation for future growth through efforts to create multiple earnings bases and maximize cash flow, through product mix improvement accompanying sales growth from high-value-added products such as functional yogurt and from cheese and other mainstay products, and through scale expansion from continued marketing investment in the nutrition business sector. Nevertheless, profit decreased due to factors including sluggish growth in sales of mainstay products in a difficult competitive environment and an inadequate response to cost increases.

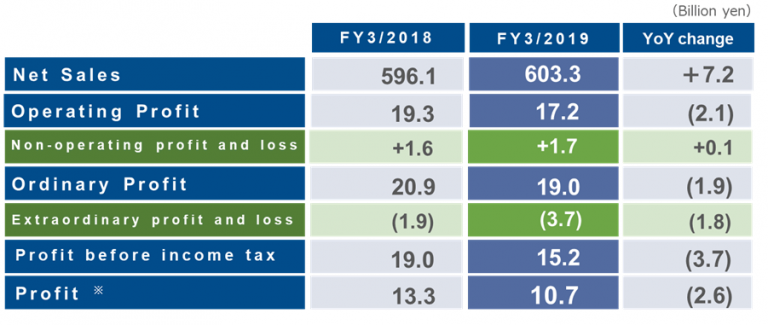

As a result of these developments, in the fiscal year ended March 31, 2019, consolidated net sales were ¥603,378 million (an increase of 1.2% over the previous fiscal year), operating profit was ¥17,230 million (down 11.0%), ordinary profit was ¥19,014 million (down 9.4%), and profit attributable to owners of parent was ¥10,754 million (down 19.7%). Because of its increased importance, Luna Bussan Co., Ltd. has been accounted for as an equity-method affiliate for the fiscal year ended March 31, 2019.

FY3/2019 Consolidated Operating Results

Net sales

Sales of Yogurt and functional foods increased, consolidated net sales increased ¥ 7.2 billion compared to the previous fiscal year.

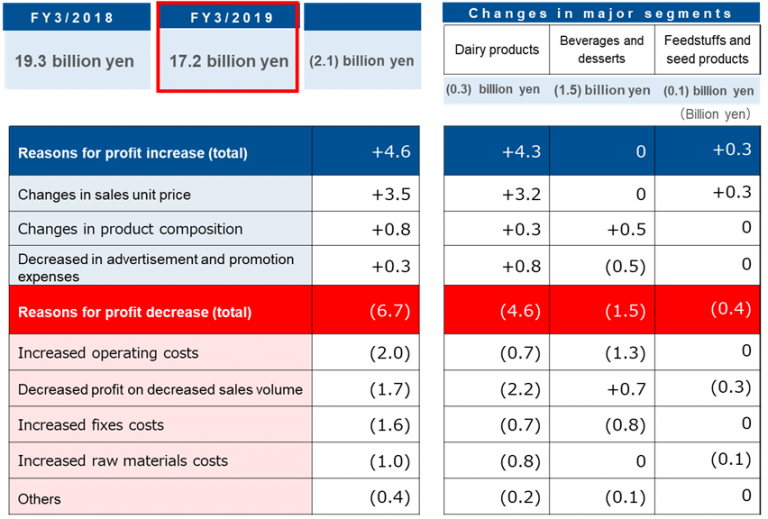

Operating profit

Operating profit was ¥ 17.2 billion. Profits increased by ¥ 4.6 billion, including a ¥ 3.5 billion difference in sales unit price due to price revisions of cheese, and a ¥ 800 million difference in product composition due to sales growth of functional yogurt. On the other hand, the decrease in profit was ¥ 6.7 billion. This is due to the decrease of profit by ¥ 2 billion caused by the increase of operation cost (logistics cost, energy cost etc.), the decrease of ¥ 1.7 billion mainly due to the decrease of sales volume because of the price revision of cheese etc., and also due to the increase in fixed costs by ¥ 1.6 billion, such as labor costs and depreciation costs. As a result, operating profit totally decreased ¥ 2.1 billion compared to the previous fiscal year.

Breakdown of Factors Affecting Changes in Consolidated Operating Profit

Major factors indicated. Refer to the earnings summary supplemental information for a detailed breakdown.

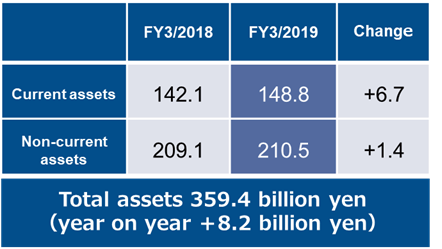

Analysis of financial status

Assets

Total assets increased ¥ 8.2 billion compared to the end of the previous fiscal year.

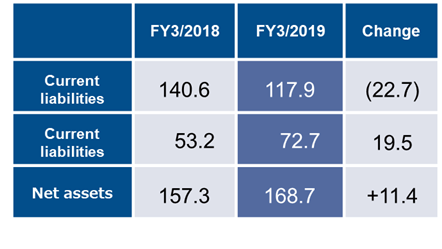

Liabilities and net assets

Liabilities decreased by ¥ 3.2 billion compared to the end of the previous year.

Net assets increased ¥ 11.4 billion compared to the end of the previous fiscal year.

The equity ratio improved 2.2 points over the end of the previous fiscal year to 46.3%.

Consolidated Balance Sheets

【Current assets】

Receivables: +5.4 billion yen

Inventories: +1.7 billion yen

【Non-current assets】

Investment securities: +6.1 billion yen

【Current liabilities】

Short-term loans payable: (21.8) billion yen

【Non-current liabilities】

Bonds payable: +10.0 billion yen

Long-term loans payable: +8.7 billion yen

【Net assets】

Shareholders’ equity: +11.2 billion yen

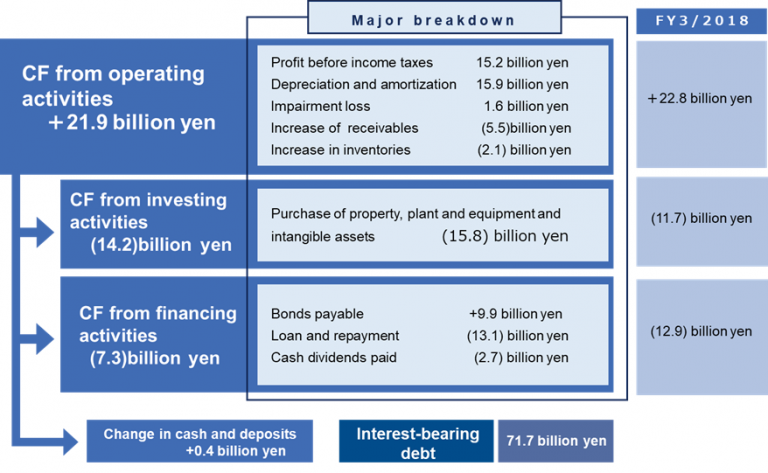

Cash flow analysis

In the fiscal year under review, we issued bonds for the first time, generating ¥ 9.9 billion. In addition, the balance of cash and cash equivalents, which stood at ¥ 14 billion at the beginning of the fiscal year, was ¥ 14.3 billion at the end of the fiscal year.