Medium-term Management Plan

Management Plan

-

2020.05.13

Group Medium-term Management Plan 2022

Group Medium-term Management Plan 2022

-

2020.05.13

Notice on Adoption of Megmilk Snow Brand Group Medium-Term Management Plan 2022

Notice on Adoption of Megmilk Snow Brand Group Medium-Term Management Plan 2022

-

2017.05.11

Establishment of the Megmilk Snow Brand Group “Group Long-term Vision 2026,” “Group Medium-term Management Plan 2019” and Overview of the “Megmilk Snow Brand Values”

Establishment of the Megmilk Snow Brand Group “Group Long-term Vision 2026,” “Group Medium-term Management Plan 2019” and Overview of the “Megmilk Snow Brand Values”

-

2017.05.11

Megmilk Snow Brand Group “Group Long-term Vision 2026,” “Group Medium-term Management Plan 2019”

Megmilk Snow Brand Group “Group Long-term Vision 2026,” “Group Medium-term Management Plan 2019”

Group Medium-term Management Plan 2020

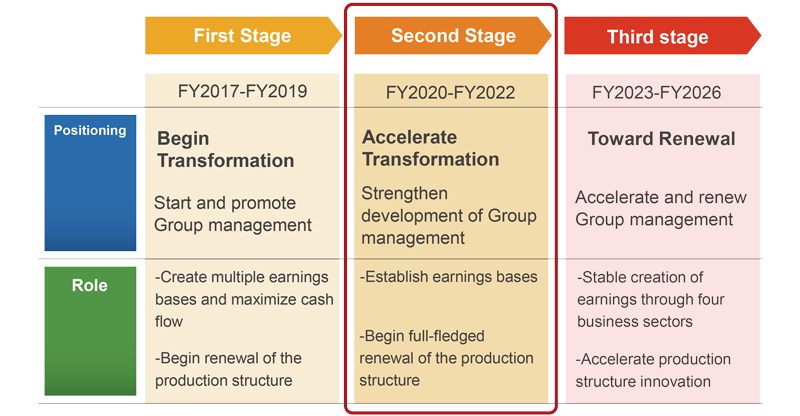

The Group Medium-term Management Plan 2022 will be advanced as the implementation plan for the Second Stage of the action period for the Group Long-term Vision (FY2017 to FY2026).

Pushing ahead with productivity reforms, resolute implementation of business structure reforms, and initiating a full-fledged renewal of our production structure in order to accelerate our transformation are the key strategies in aiming to establish earnings bases in four business sectors.

Medium-term Management Plan benchmarks

Megmilk Snow Brand Group has set the following benchmarks for our Medium-term Management Plan.

| Performance indicators | FY2022 goal figures |

|---|---|

| Consolidated net sales | 640 billion yen |

| Consolidated EBITDA | 41 billion yen |

| Consolidated operating profit | 22 billion yen |

| Items | Target |

|---|---|

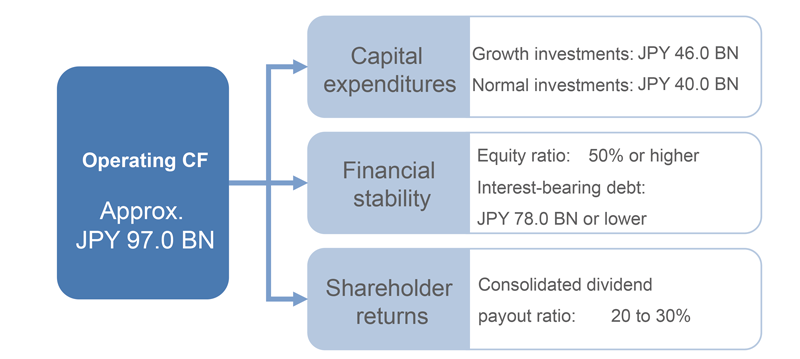

| Total investment (3 year total) | 86 billion yen |

| Consolidated ROE | 8% or higher |

| Consolidated equity ratio | 50% or higher |

| Consolidated payout ratio | 20% ~ 30% |

Core function strategy

- Enhance Group management

- Initiatives to achieve sustainable Group development

Core function strategy

- Apply bussiness strategy to achieve transformation and renewal to innovate production structure

- Strengthen manufacturing (monozukuri) and creating new value

- Promote Group management to strengthen Group core competency

- Initiatives to achieve sustainable Group development

Strategy by business sector

Dairy Products

Dairy Products | Dairy Products Business Sector |

|

[Dairy Products] including Nutrition Business

| (Billion yen, %) | ||||

|---|---|---|---|---|

| FYE3/2020 | FYE3/2023 (forecast) | Change | Growth rate (vs. FYE3/2020) | |

| Net saless | 249.0 | 275.0 | +26.0 | 110.4 |

| Operating profit | 11.5 | 14.0 | +2.5 | 121.7 |

Start operations at new butter building in Isobunnai Plant

| u FY2021 Full start of new Isobunnai butter building u Latest production facilities to promote optimization and structure to increase production |  |

Consumer butter production and sales plan

Expand sales of consumer cheese

Firm sales of consumer cheese in Japan on strong demand

Expand sales of commercial cheese

| 1. Expand soft cheese 2. Expand sales of natural cheese products in Japan 3. Promote pricing revisions and product mix improvements |  |

Strengthen Taiki Plant production structure

1. Utility facilities

Upgrade wastewater, water collection, and power facilities to enable increased production

2. Sakeru Cheese

Adopt AI auto product inspection to increase efficiency and production

3. Camembert

New wing construction and optimization investments to enable increased production

Consumer butter production and sales plan

Borderless cheese market

Snow Brand Australia (SBA) Snow Brand Australia (SBA)Offer in major mass volume channels with focus on Unicorn Brand |  |  |

Udder Delights Australia (UDA) Udder Delights Australia (UDA)Produces high value-added products such as premium blue cheeses and organic products. Offer through commercial sales channels and luxury food channels. |  | |

Megmilk Snow Brand Indonesia (MSBI) Megmilk Snow Brand Indonesia (MSBI)Offer mainly sliced and block cheese. Also offering original soft cheese as commercial product. |  |

3 company transitions in cheese sales

Beverages and Desserts

Beverages and Desserts | Beverages and Desserts Sector |

|

[Dairy Products] including Nutrition Business

| (Billion yen, %) | ||||

|---|---|---|---|---|

| FYE3/2020 | FYE3/2023 (forecast) | Change | Growth rate (vs. FYE3/2020) | |

| Net saless | 283.9 | 280.0 | (3.9) | 98.6 |

| Operating profit | 5.2 | 6.0 | +0.8 | 115.4 |

Enhance development of functional yogurt

Expand sales of yogurt business

◆ Firm sales of consumer yogurt products

Firm hold on No. 1 share of market

| ●Launch operations at new desserts wing at Luna Bussan Production structure development  Luna Bussan exterior | ●Review product line to improve profitability and develop new core products Enhance distinctive individual serving products  |

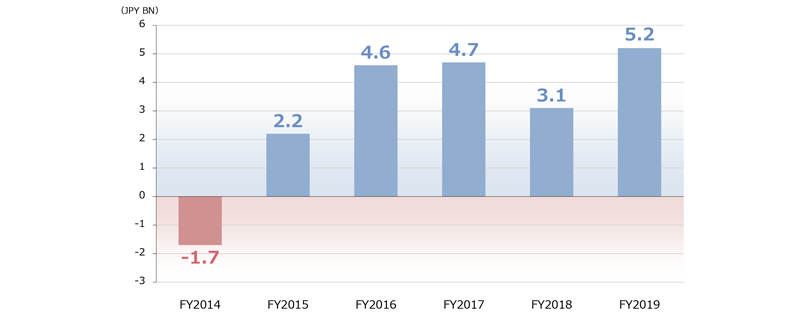

Transitions in operating profit of beverages and desserts business segment

◆ Stabilizing operating profits

Structural reform goals for milk business

Achieve operating profit by end of FY2026

Initiatives to achieve operating profit in milk business

Initiatives to improve added value |  |

Develop and adopt distinctive, high-value added products

◆ Adopt product containers with caps

Optimize production structure

◆ End production of Nagoya Plant and consolidated into Toyohashi Plant (Mar. 2020)

◆ End production of Nagoya Plant and consolidated into Toyohashi Plant (Mar. 2020)

◆ Create more efficient beverages and desserts business production structure

Nutrition

Nutrition | Nutrition Business Sector |

|

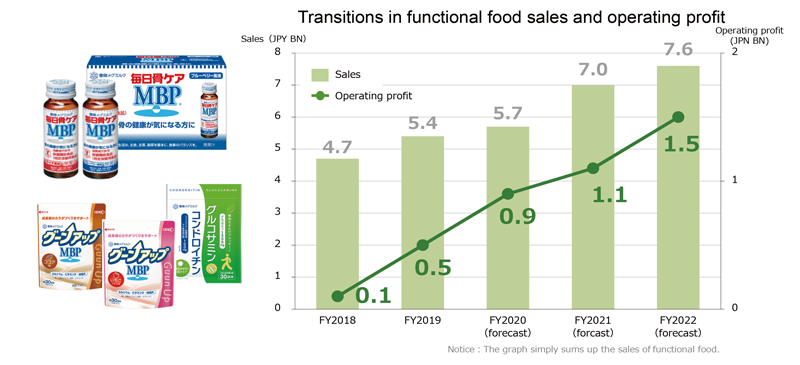

Nutrition Business Sector

| (Billion yen, %) | ||||

|---|---|---|---|---|

| FYE3/2020 | FYE3/2023 (forecast) | Change | Growth rate (vs. FYE3/2020) | |

| Net saless | 18.4 | 21.0 | +2.6 | 114.1 |

| (Breakdown) | ||||

| Functional foods | 5.4 | 7.6 | +2.1 | 140.7 |

| Infant formula and other | 12.9 | 13.4 | +0.5 | 103.8 |

Initiatives to achieve operating profit in milk business

Increase brand loyalty |  |

Transition in earnings and goals

Feedstuffs and Seed Products

Feedstuffs and Seed Products | Feedstuffs and Seed Products |

|

Nutrition Business Sector

| (Billion yen, %) | ||||

|---|---|---|---|---|

| FYE3/2020 | FYE3/2023 (forecast) | Change | Growth rate (vs. FYE3/2020) | |

| Net saless | 43.7 | 44.0 | +0.3 | 100.7 |

| Operating profit | 1.0 | 1.0 | 0 | 100.0 |

Construct new plant via joint venture

◆Construct new company through joint venture between Hokuren Cooperative Feed Mills Co., Ltd.

and Snow Brand Seed Co., Ltd.

Firm position and No. 1 for grass and green fertilizer

◆ Expand vegetable, green fertilizer, and microbes business

◆ Use new research facility to promote new seed development

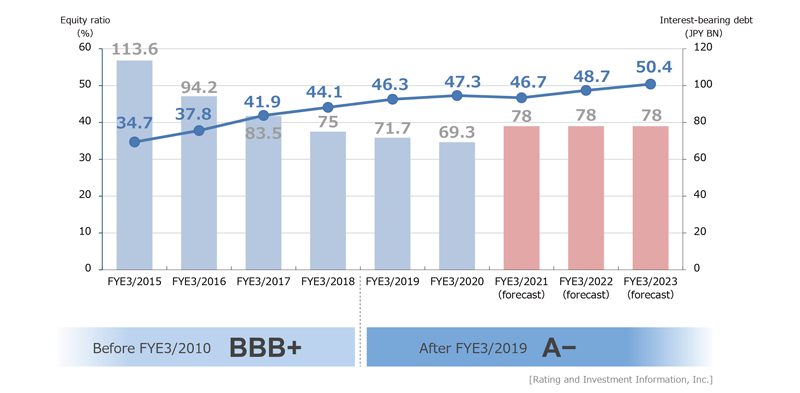

Equity ratio, interest-bearing debt, rating

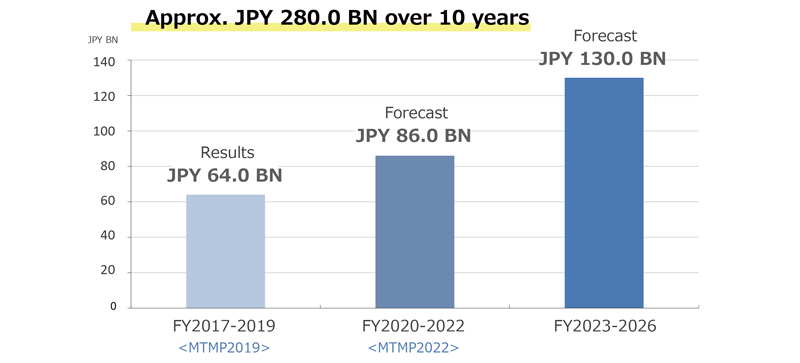

Capital expenditure results and forecasts

Cash flows

Accept Read More