Message from the Executive Officer Responsible for Finance

- Fiscal 2024 Results and Review

Business Environment and Financial Results

In fiscal 2024, private consumption in Japan maintained a trend of moderate recovery overall on the back of wage increases, recovery of inbound tourism demand, government economic policies, and other factors, despite the headwinds of inflation and decline in real wages. In financial and capital markets, the Bank of Japan ended its negative interest rate policy in March 2024, raising interest rates for the first time in 17 years. As a result, long-term interest rates also rose, and there was a correction in the weak yen on foreign exchange markets.

In its consolidated financial results for fiscal 2024, the Megmilk Snow Brand Group recorded 615.8 billion yen in net sales, up 1.7% year on year, 19.1 billion yen in operating profit, up 3.6% year on year, and 20.2 billion yen in ordinary profit. Profit attributable to owners of parent amounted to 13.9 billion yen, down 28.4%, due to the impact of selling cross-shareholdings in the previous year. The equity ratio has remained consistently above 50%, having increased by three points from 53.8% in fiscal 2023 to 56.8%. These financial results indicate that categories such as beverages and cheese remain strong in the market even after price increases, which we believe shows the revisions have been accepted by customers.

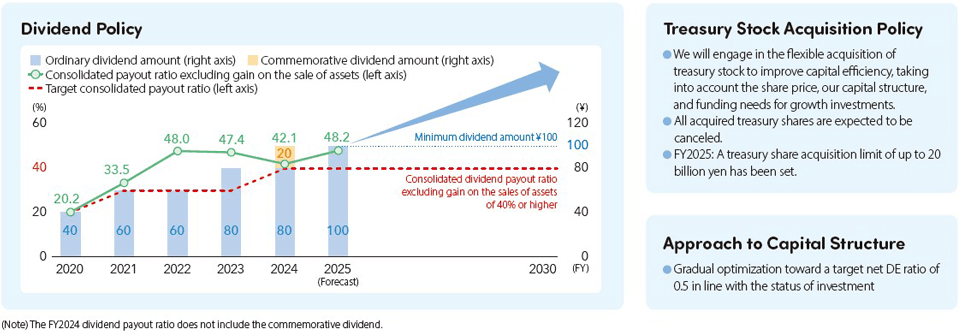

Shareholder Returns and Asset Efficiency

In light of our strong financial results, we raised the dividend payout level from “30% or higher” to “40% or higher excluding gain on the sale of assets.” Furthermore, as we celebrated the 100th year of the company’s founding on May 17, 2025, we paid a commemorative dividend of 20 yen per share in addition to the ordinary dividend of 80 yen to express our gratitude for the constant support of our shareholders, bringing the total dividend to 100 yen per share and thereby enhancing shareholder returns.

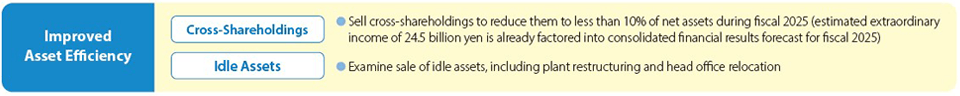

In terms of reducing assets, which is part of our efforts to increase asset efficiency, we sold the site of the Nagoya Plant and reduced cross-shareholdings. Continuing from the previous year, we sold six listed stocks after holding dialogue with business partners. As a result, the net asset percentage of cross-shareholdings decreased by 0.8 points from 17.9% at the end of fiscal 2023 to 17.1% at the end of fiscal 2024.

Remaining Challenges in Group Medium-Term Management Plan 2025

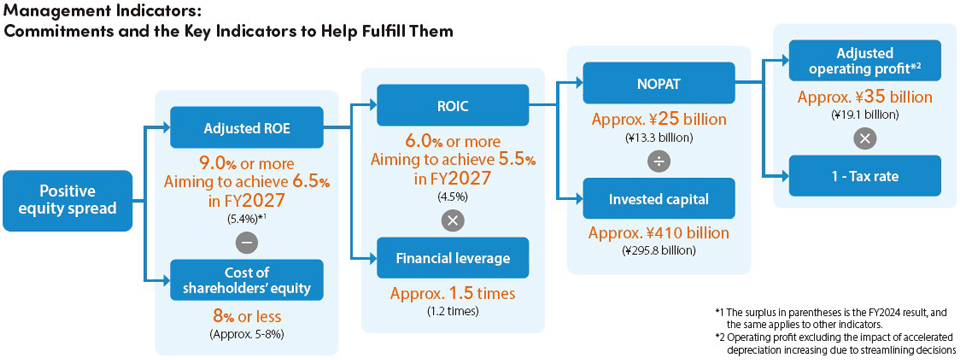

The Group’s PBR remained at 0.7, under the 1.0 mark, as of March 31, 2025, which we recognize as a challenge. We believe this is because ROE and ROIC are at a level below the cost of capital and because we have not adequately presented the concrete initiatives for our future growth strategy and our capital measures to shareholders. Believing that the Group must accelerate measures aimed at making improvements, we formulated our new business plan, Next Design 2030, to increase our profitability and growth potential as well as to gain further trust in our capital measures.

- New Business Plan: Next Design 2030

① Transformation of the Business Portfolio and Megmilk Snow Brand's Assets

From a medium- to long-term perspective, the Group manages its business portfolio using the degree of contribution to food sustainability on the vertical axis and indicators aligned to market growth potential multiplied by our profitability on the horizontal axis. Under Next Design 2030, we will work to transform this business portfolio.

We will invest capital in the priority and growth categories where high profit and growth are expected. In business sectors that have become commoditized, we will promote streamlining, including collaboration and outsourcing, in addition to reorganization, including partial withdrawal from businesses.

More specifically, we will aggressively invest in businesses where high profit and growth are expected, such as cheese, yogurt, functional ingredients, and the overseas business. At the same time, in categories such as milk and milk-based beverages, we will pursue an asset-light strategy that includes streamlining our business assets and pursuing collaboration with other companies to improve productivity and profitability. As part of these initiatives, in the area of cheese production systems, we are implementing large-scale capital investment of approximately 47.5 billion yen in the Nakashibetsu Plant in Hokkaido and the Ami Plant in Ibaraki Prefecture to facilitate production of highadded- value cheese and increase competitiveness. In the area of milk and milk-based beverages, we have decided to consolidate production lines in conjunction with the termination of production at the Kobe Plant. We will also examine initiatives to achieve the sustainable and efficient stable supply of products in collaboration with the Satsuraku Agricultural Cooperative.

In addition, we will actively promote investment in intangible assets. Over the six years through fiscal 2030, we will invest approximately 20.0 billion yen in corporate branding to enhance brand value, strengthening sustainability initiatives, and research and development, and approximately 3.0 billion yen in improving productivity and strategic capabilities through digital transformation (DX). Going forward, we will step up investment in corporate branding to more clearly communicate the Group’s commitment to solving social issues. Our ultimate hope is that consumers will feel an affinity with the Group’s efforts and purchase our products. Furthermore, we believe that our employees are the starting point for enhancing brand value, and we will pursue human capital investment to increase engagement. In addition, we will leverage DX to build a framework for utilizing data in all aspects including sales, production, and research, while also promoting the development of DX personnel to improve our strategic capabilities.

② Financial Strategy

Assessment of Current Financial Position and Basic Policy

As a result of generating stable operating cash flow, the Group has maintained its equity ratio at above 50% and the net DE ratio is also at an all-time low level. As a result, we believe we have adequately secured financial soundness. Going forward, the Group considers that it has transitioned to the stage of effectively utilizing the equity it has built up to enhance corporate value. While maintaining our external “A” rating, we will continue implementing leveraged “aggressive investments” and “asset efficiency improvements,” control our balance sheet, and make improvements to ensure the return on capital exceeds the cost of capital.

Balance Sheet Management

We will continue working to reduce cross-shareholdings, which we have been pursuing since Group Medium-Term Management Plan 2025. In addition to reducing cross-shareholdings to less than 10% of net assets by the end of fiscal 2025, we will implement an asset-light strategy that will reduce the Group’s fixed assets such as manufacturing sites and logistics facilities. We will dramatically improve productivity and profitability while also increasing asset efficiency by reducing the Group’s assets, restructuring plants, including collaboration with other companies, and selling idle assets and allocating the cash to functional ingredients and the overseas business, which are growth areas. We will also endeavor to increase funding efficiency by reducing the balance of cash and deposits, given the rising burden of interest as the Bank of Japan starts to lift interest rates.

Cash Allocation and Investment Policy

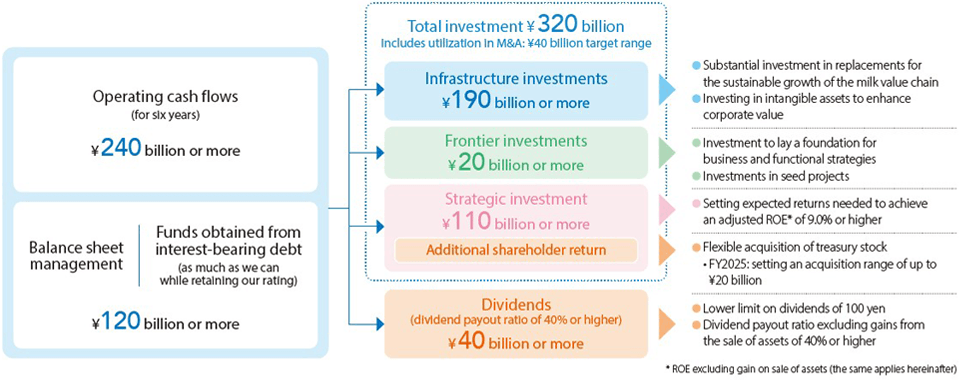

Over the six years through fiscal 2030, we will use our operating cash flows of approximately 240.0 billion yen, along with approximately 120.0 billion yen in interest-bearing debt and cash inflows from asset sales, as funding sources for implementing growth investment. We will categorize investments according to their position in the business portfolio into infrastructure investments, frontier investments, or strategic investments, and we will decide on individual projects based on the significance, necessity, and expected return on the investment. In particular, for strategic investments, we have set expected returns needed to achieve an adjusted ROE* of 9.0% or higher and will implement investment of 110.0 billion yen or more. We plan to invest 320.0 billion yen in total, and, included in this amount, we are also considering pursuing M&As with a target range of approximately 40.0 billion yen, to accelerate growth. Specifically, we intend to consider M&As with a particular focus on strengthening overseas expansion, growing priority functional products, and expanding alternative food products

Capital Measures

We will allocate operating cash flows, utilization of interestbearing debt, and cash inflows from asset sales to growth investment first, and return cash that exceeds the level of growth investment to shareholders. As our dividend policy, we have set a minimum dividend amount of 100 yen in addition to a consolidated dividend payout ratio excluding gain on the sale of assets of 40% or higher, and we will pay dividends consistently. We have decided to engage in the flexible acquisition of treasury stock with the aim of increasing capital efficiency, while taking into account the share price, our capital structure, and funding needs for growth investment. We plan to cancel all acquired treasury shares. For fiscal 2025, we set a 20 billion yen treasury share acquisition limit. Moreover, we will gradually optimize our capital structure toward a target net DE ratio of 0.5, in line with the status of investment under our policy of pursuing “aggressive investment” utilizing interest-bearing debt.

Fiscal 2030 Vision

We will translate our commitment to addressing the social issue of food sustainability into an increase in the Group’s brand value, strengthen trust in our products and the company itself, and deliver sales growth and higher added value. Furthermore, we will pursue cost reductions and increases in production efficiency by building a sustainable supply chain and developing environmentally friendly production technology. Under the concept of “drastically transforming Megmilk Snow Brand’s assets,” we will move forward on two fronts: improving profitability and growth potential through business portfolio transformation and improving asset efficiency and capital efficiency through balance sheet management and capital measures. By realizing a positive equity spread through the achievement of adjusted ROE of 9.0% or higher and ROIC of 6.0% or higher, we aim to establish a strong presence as a company that is committed to enhancing corporate value.

Initiatives in Fiscal 2025

Fiscal 2025 marks an important year in which the Group celebrates its 100th anniversary and will embark on the first step toward dramatic growth for the next 100 years. We are focusing on investment aimed at medium- to long-term growth, and we will also invest in human resources and digital transformation (DX) in addition to deploying communication measures to commemorate our 100th anniversary and investing in strengthening the Group’s corporate brand. Furthermore, we will pursue a reduction in cross-shareholdings to improve asset efficiency.

In its financial results forecast, the Group predicts net sales of 640.0 billion yen and operating profit of 19.0 billion yen, the latter at the same level as in the previous year, taking into account communication measures to commemorate our 100th anniversary and corporate brand investment, with profit attributable to owners of parent anticipated to come in at 30.0 billion yen, factoring in an expected gain on sale of investment securities.

- Steps to Increase Corporate Value

We believe that working to achieve food sustainability while enhancing corporate value means that we will redefine the existing model of dairy farming and the dairy industry and move it forward to build a sustainable business model ready for the next generation. Looking ahead to the next 100 years, the Group will transition from the conservative investment policy we have pursued up to this point to a policy of using interest-bearing debt to make growth investments and decisively transform the Group’s assets unconstrained by the existing framework. To achieve the management indicators presented in our new business plan, Next Design 2030, we will draw up and execute concrete plans that support the feasibility of the Group’s growth strategy. We will also provide timely disclosure on the progress of our initiatives. As we continue to enhance corporate value and build long-term relationships of trust with our investors, we hope you are looking forward to what is to come.